VAT Refund In Turkey For Tourist, Step By Step Tutorial 2024

Tax Free Shopping In Turkey

Due to its geographical location and natural tourist attractions, Turkey interests many tourists. Shopping in this country is also very popular due to clothing stores in Istanbul and other Turkish cities. But one feature that makes shopping in Turkey attractive is the VAT refund in Turkey for tourists.

During my trip to Istanbul, I bought many goods from tax-free stores. By filling out the tax-free forms in the stores, I could get back the tax that I paid during the purchase. If you are also interested in learning about the terms of Turkey’s VAT refunds and how you can get back the taxes you paid, read this article to learn about my experience.

Step By Step Tutorial

Table of Contents

Step 1: Shop at stores that have a tax-free label.

Step 2: After choosing the products and paying the fee, you must fill out the tax-free forms in the store.

Step 3: Go to the VAT Refund section at the airport and show the goods you bought along with the tax-free form you received from the store to the customs officer to confirm them.

Step 4: Go to the Global Blue section for your tax refund.

How much is a VAT refund in Turkey for tourists?

In Turkey, cosmetics, jewelry, watches, and electronic devices have 18% VAT, and clothes, shoes, bags, and the like have 8% VAT.

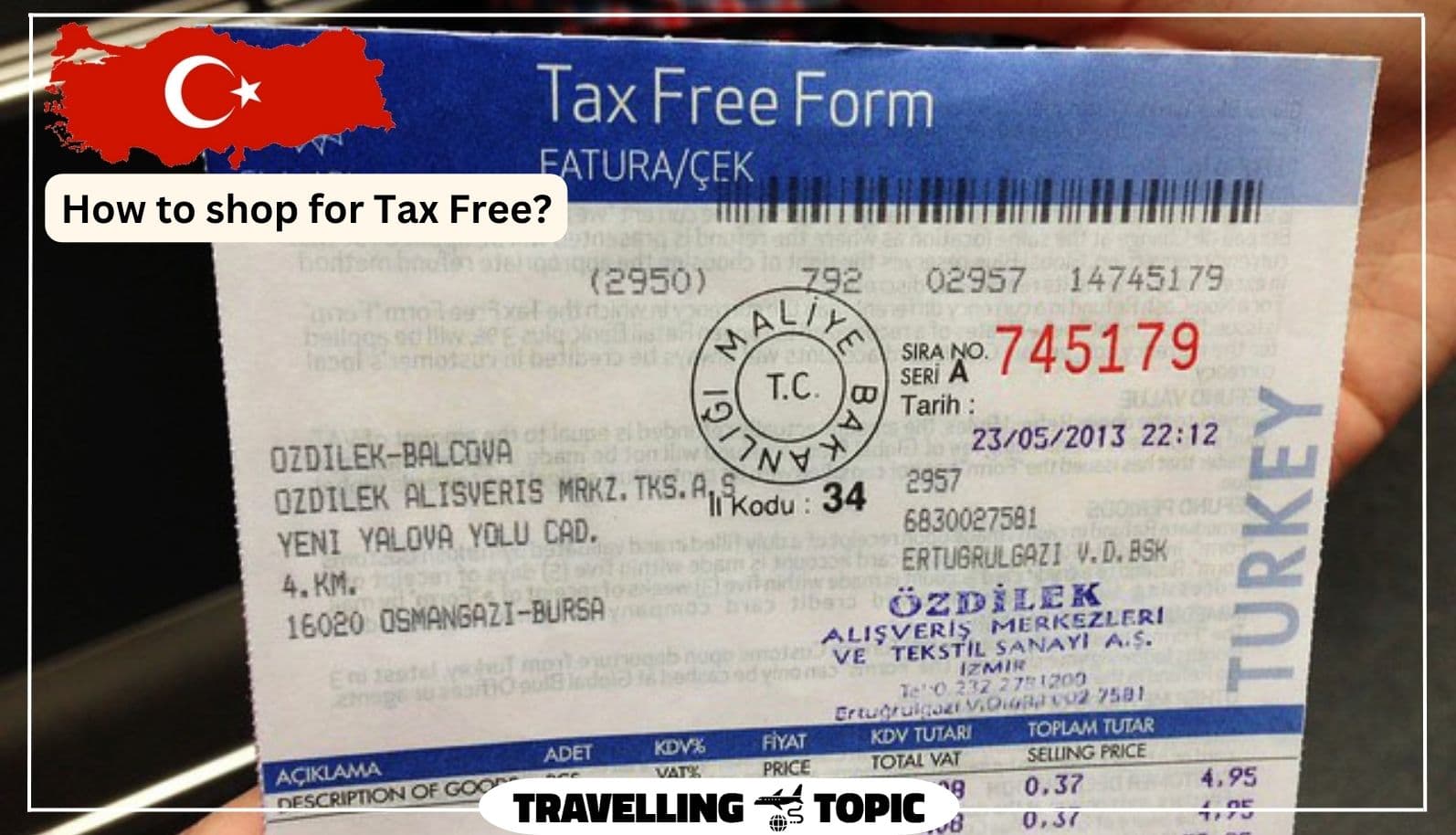

How to shop for Tax Free?

The most crucial point is that you must carry your passport with you on all the days you plan to shop. Most stores in Turkey, especially clothing stores, are familiar with the tax-free process. You only have to ask the cashier to issue you a tax-free certificate when you pay for your bought.

Each store issues a tax-free certificate separately according to its business policy. First, they will give you a general receipt of all the purchases; then, they will print a separate tax-free receipt and give it to you. The only thing you should be aware of is that all receipts and sheets must have the store’s mark.

Suppose you want only one person to process the tax refund at the airport. In that case, I suggest that you make all purchases under the name and passport of one person because, at the airport, only the person whose name is recorded in the receipts will be refunded the tax. In this way, you can save time, and there is no need for several people to stand in line to withdraw money.

Pay attention to the fact that the minimum purchase amount for tax-free in Turkey is 118 lira in 2024, which means that if you buy an item with a price of 100 liras, you cannot get back the tax you have paid.

How do I get my tax back from airport Turkey?

Many stores put tax-free slips inside an envelope with instructions on how to do the VAT refund process in Turkey for tourists.

The first thing you should consider is that the baggage delivery and boarding pass section for the tax-free process differs from the routine flight. It doesn’t matter which airline ticket you bought and to which destination. If you want to get back the tax on your purchases, you must do it at the Vat refund section or the customs section.

Next, I explain the steps for vat refund in Turkey for tourist:

If your flight was Turkish Airlines, when you enter Istanbul International Airport, you should go to row G, called the VAT Refund section. This section has two parts. First, you must stand in line and hand over your documents to get a boarding passes; remember to declare that your purchases are tax-free. I suggest putting all your purchases in one suitcase and carrying only a piece of baggage.

You must go to the Custom area with your luggage when you get the boarding pass. There you have to hand over your passport and purchase receipts. The customs officer can check each of the purchases included in the invoice. For example, he may ask you to show the shirt you bought from Koton; if you can’t show the clothes you bought, they won’t give you a refund.

After checking each invoice, the customs officer puts a special stamp on it and gives it to you. Please note that only stamped invoices are valid for a refund.

If your ticket was related to other airlines, you should go to the section specified for you, which will guide you to the VAT Refund section.

Where is the tax refund at Istanbul Airport?

At the Turkey Istanbul airport, after checking and stamping the passport, go a little further in the transit area. Next to the escalators is an exchange office called Global Blue, where you have to go and hand over the stamped invoices. Then they will pay your money.

The important thing is that this money is your right, So be sure to get your money. Just be careful that getting a flight card for tax-free mode will take longer and have a long queue. So be sure to get to the airport earlier than usual to do this process safely.

Is paying taxes in Turkey different for Turkish and non-Turkish people?

Final word

In the end, you should know that you should not use any of the goods you have purchased until the tax is refunded at the airport. Otherwise, the tax will not be refunded to you.

You should also know that you can receive your tax in cash at the airport for a small fee or get this amount back after returning to your country without reducing the cost.